Additive manufacturing industry grows in 2020 despite pandemic

The additive manufacturing (AM) industry grew by 7.5 percent despite the COVID-19 pandemic, according to a new report produced by the Wohlers Associates consulting firm.

However, Wohlers Report 2021 released March 16 said growth was down considerably as compared to an average annual growth of 27.4 percent over the past 10 years.

Many established manufacturers of additive manufacturing systems saw a decline in equipment sales, but many less-established companies grew in 2020, the report said.

The report looks at the $12.8 billion industry, including AM systems, parts produced by AM systems, materials used in AM, and aftermarket products for AM systems, such as software and lasers. Excluded from the survey is money spent on AM in-house by corporations such as Nike, Airbus, Toyota, and thousands of others, both large and small. It also excludes the value of research, development, prototyping, tooling, and production with AM at these companies.

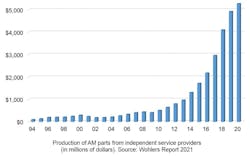

Independent additive manufacturing service providers were among those who saw an increase in business. They reported a 7.1 percent growth in business worldwide, resulting in nearly $5.3 billion of revenue.

The 375-page Wohlers Report includes information from 124 service providers, 113 manufacturers of AM machines, and 24 producers of third-party materials. Eighty-eight co-authors and contributors from 34 countries provided expert views and perspectives.

Wohlers Associates has been producing the annual report for 26 years.

Terry Wohlers, principal consultant and president, discussed some of the report’s key findings and his view of the future of the industry with Plastics Machinery & Manufacturing senior reporter Bruce Geiselman.

What has been the impact of the COVID-19 pandemic on 3-D printing?

Wohlers: COVID-19 has challenged everyone within the industry, but it has also brought an awareness to the technology in ways we have not seen before.

Due to the economic downturn caused by the pandemic, companies paused research and development projects and large capital investments. In contrast, many organizations turned to 3-D printing to address supply chain gaps. The pandemic has created pent-up demand for AM products and services, which could trigger strong growth in 2021 and 2022.

Did it surprise you that AM, while still growing last year, saw a dramatically reduced rate of growth as compared to previous years?

Wohlers: No. 2020 was a challenging year for most organizations due to the global pandemic.

An economic recession, coupled with a collapse of “norms” [in terms of how businesses normally operate], contributed to the downturn. Moderate growth was a pleasant surprise and exemplifies how AM is an important part of the future of manufacturing across many industrial sectors.

Why are established manufacturers of AM technologies apparently losing business to less-established companies?

Wohlers: The industry is indeed seeing an increasing number of less-established manufacturers of AM systems. This has increased competition, causing more creative and innovative solutions, coupled with lower pricing.

You report that in 2020 there was a 7.1 percent growth in sales from independent service providers. What accounts for this, and who are their customers?

Wohlers: A customer for a service provider can range from an individual who wants to build one figurine to a large organization wanting to manufacture an entire product line using AM.

A typical customer is one who prefers to outsource part or all of its 3-D printing needs. A production run for service providers can range from one custom part to thousands.

Manufacturers work with service providers instead of bringing all 3-D printing capacity in-house for a few reasons. Industrial additive manufacturing, post-processing and part finishing require training and experience. Working with a service provider to manufacture AM parts can reduce overhead, hiring and space requirements for companies wanting to adopt AM.

What is happening with 3-D printing software?

Wohlers: Special CAD tools and software for topology optimization and generative design continue to develop and improve.

These software products are becoming more user-friendly, but it still takes time and effort to learn and use efficiently. For 3-D printing, it is important to learn how to design for additive manufacturing to produce parts in a cost-effective way and to improve product performance.

Are you seeing new plastic materials being developed for use in 3-D printers, and do they have special properties?

Wohlers: New polymers for 3-D printing are being developed and released regularly.

With these new polymers, the breadth of applications expands.

Contact:

Wohlers Associates Inc., Fort Collins, Colo., 970-225-0086, www.wohlersassociates.com

Related stories

From prototypes to production, manufacturers harness evolving 3-D technology.

Printing's advantages shine in pandemic, says 3DChimera co-founder.

Rize executives say printing offers personalization at push of a button.

Stratasys to launch production-scale 3-D printers.

Industry survey finds use of AM is expanding beyond prototyping and R&D.

3YourMind sees a growing market for printing spare parts.

Jabil develops a new high-strength filament to meet customer demand.

About the Author

Bruce Geiselman

Senior Staff Reporter Bruce Geiselman covers extrusion, blow molding, additive manufacturing, automation and end markets including automotive and packaging. He also writes features, including In Other Words and Problem Solved, for Plastics Machinery & Manufacturing, Plastics Recycling and The Journal of Blow Molding. He has extensive experience in daily and magazine journalism.