Additional US production good sign for robot market

A few interesting things encountered in recent travels:

Wittmann Battenfeld Inc. hosted an open house and innovations workshop at its Torrington, Conn., U.S. headquarters last month with plenty of its latest equipment running in demonstrations.

But one of the most interesting things on display was the company's new 50,000-square-foot plant. The new building will enable Wittmann to double its U.S. production of robots to about 1,000 a year.

David Preusse, president of Wittmann's U.S. business, said that a new paint booth, machining center and welding booth have been installed, and a new robot assembly line is being configured like one in Wittmann's Vienna robot plant.

"We can even build mounting brackets in-house," Preusse said. The robot market is booming worldwide, including in the U.S. and even more so in Mexico. Increased capacity at Torrington will bring Wittmann's worldwide robot capacity to about 5,000 per year.

North American robot sales for all industries set a record in 2015 and data from the Robotic Industries Association (RIA) showed first-quarter sales in 2016 were the strongest ever. The automotive industry continues to lead the way, but RIA said several other sectors showed big increases. The number of robots sold to plastics and rubber companies was up 44 percent over the same quarter last year.

It is heartening to see Wittmann investing heavily in its U.S. manufacturing operation.

•••

Another robot maker is bringing production to this country. Sepro America, the U.S. business unit of Sepro Group, La Roche-sur-Yon, France, plans to start assembling robots at its Warrendale, Pa., facility in the fourth quarter of 2017. Sepro plans to source beams and some other components locally, but the technical components will continue to be manufactured in France.

Sepro already has substantial engineering and assembly capability in Warrendale, where it designs and builds complex, integrated automation cells for delivery in North America.

Jim Healy, VP sales and marketing, said the initial focus will be on assembling Sepro's new large robots for use with injection molding machines with more than 800 tons of clamping force. The goal is to optimize delivery to North American customers while maintaining quality.

It expects to sell about 2,500 robots and sprue pickers worldwide this year, according to Sepro Group CEO Jean-Michel Renaudeau, with about 500 units going to companies in the U.S. and Canada.

•••

It seems just a short time has passed since the Wittmann Group, then a manufacturer of robots and auxiliary equipment, acquired the Battenfeld injection molding press business that was on the brink of closing its doors for good. That was in April 2008, and we all remember what happened just a few months later. "By the time of the Fakuma trade fair in October, the market for new machinery had started to crash," said Michael Wittmann, GM of the Wittmann Group.

But things have changed. At its U.S. open house, Wittmann said that the Battenfeld business has now been profitable for a couple of years. Some 80 percent of current revenue is coming from machines designed after 2008.

How did it happen? "They had a good design and engineering staff, and we retained every one of them," Wittmann said. "But Battenfeld had the attitude that it was a big company. We had to change their attitude to being a smaller company, to be more aggressive and nimble."

Wittmann management also did a lot of other things, such as reducing production costs, expanding the product line, enlarging and investing in the Austrian factory and generally positioning the combined companies as the first company that could provide a truly integrated range of injection molding products.

The Battenfeld turnaround story from insolvency to profitability would make a great business school case study on how a strategic investment along with good leadership can result in success.

•••

Euromap 77 is a term that is soon going to become very familiar to the injection molding community. It is the new industry standard for exchanging data between injection molding machines and central plant computers or manufacturing execution systems (MES).

The standard is being developed by representatives from Arburg, Engel, Ferromatik, Milacron, KraussMaffei, Netstal, Negri Bossi, Sumitomo Demag and Wittmann Battenfeld.

Why is it important? The many components of a smart factory need to be able to communicate seamlessly. Connecting all those devices needs to be accomplished easily on the plant floor.

Euromap 77 was on display at the K show in a demonstration that involved collecting incoming live data from different manufacturers' machines running in booths in several halls. The demonstration turned the K Show fairgrounds into a sort of Industry 4.0 factory.

Ron Shinn, editor

About the Author

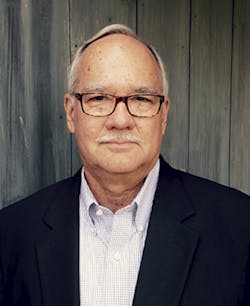

Ron Shinn

Editor

Editor Ron Shinn is a co-founder of Plastics Machinery & Manufacturing and has been covering the plastics industry for more than 35 years. He leads the editorial team, directs coverage and sets the editorial calendar. He also writes features, including the Talking Points column and On the Factory Floor, and covers recycling and sustainability for PMM and Plastics Recycling.