PLASTICS: Delivering economic clarity in fast-changing times

In today’s rapidly evolving global economy, timely and accurate economic analysis is essential for industries to adapt, grow and stay competitive. For members of the Plastics Industry Association (PLASTICS), that critical insight comes from Perc Pineda, the association’s chief economist. With more than two decades of experience spanning academia, trade associations and international financial institutions, Pineda delivers comprehensive, data-driven analysis that helps businesses across the plastics supply chain navigate complex market dynamics.

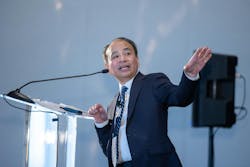

At PLASTICS’ recent Washington, D.C. Legislative Fly-In, Pineda provided member companies with an exclusive economic briefing ahead of their advocacy meetings with policymakers. His analysis helped member representatives present data-backed narratives to Congress and administration officials — highlighting the vital role of plastics in manufacturing and the broader U.S. economy.

“Providing clear, timely economic analysis is one of the most valuable ways we support our members,” Pineda said. “Whether it’s trade dynamics, equipment trends or industry performance, the data PLASTICS provides helps our members plan with confidence and stay competitive in an evolving marketplace.”

Pineda regularly contributes to PLASTICS’ blog, offering members in-depth perspectives on current economic challenges and opportunities. In a recent post titled "A Conversation on Navigating the Future of Trade," he sat down with Robert Koopman, former chief economist of the World Trade Organization, to explore how trade and shifting global alliances are reshaping the economic landscape for manufacturers.

Another piece, “Tariffs on Mexico, Canada and China: What’s at Stake for the U.S. Plastics Industry?” highlights Pineda’s analysis of the ramifications that retaliatory tariffs could have on North American trading partners. He presents a view of how policies could increase costs, disrupt supply chains and weaken U.S. competitiveness — particularly in plastics manufacturing.

Beyond blogs and commentary, Pineda oversees the quarterly Committee on Equipment Statistics (CES) report. The Q4 2024 CES report offered an insightful snapshot of capital equipment trends in the plastics sector. The analysis revealed evolving patterns in machinery demand, investment behavior and economic sentiment — valuable information that helps businesses make strategic planning and purchasing decisions.

Pineda also spearheads PLASTICS’ flagship Size and Impact Report, an annual economic profile of the U.S. plastics industry. The 2024 report revealed a $519 billion industry supporting more than 1 million American jobs, underscoring its importance to the national economy. The 2025 report will be available in September, released in conjunction with a detailed webinar provided by PLASTICS’ leadership team.

Complementing this domestic focus, the annual Global Trends Report explores international developments affecting the plastics supply chain. Pineda’s analysis includes trade flows, foreign investment and emerging market opportunities — helping members understand how shifts abroad might impact their operations at home. Pineda looks forward to releasing the 2025 Global Trends Report to an international audience in October at this year’s K Show in Düsseldorf, Germany.

“Our industry operates within a global framework, so it’s essential that our members have access to economic intelligence that reflects both domestic realities and international developments,” Pineda said. “By translating complex data into practical insights, we help businesses anticipate change, adapt strategically and lead with confidence.”

Through expert economic reporting and analysis, Perc Pineda ensures that PLASTICS members are equipped with the insights they need to succeed. His work underscores the association’s commitment to empowering the plastics industry with timely, relevant and actionable economic intelligence.

About the Author

Plastics Industry Association (PLASTICS)

The Plastics Industry Association (PLASTICS) is a purpose-driven organization that supports the entire plastics supply chain. Learn more at plasticsindustry.org/about-plastics/