Value of U.S. plastics machinery shipments drops in Q2

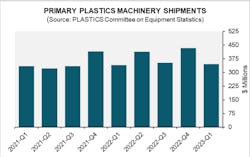

The Plastics Industry Association's (PLASTICS’) Committee on Equipment Statistics (CES) reported an estimated $331.6 million value for the primary plastics machinery (including injection molding machines and extruders) shipped in North America for the second quarter – a 4.1 percent decrease compared to the previous quarter.

When compared to Q2 of 2022, the value of shipments is down 19.8 percent.

When broken down by machine type, single-screw extruder shipments showed a 39.3 surge over the previous quarter, and a 40.9 percent increase over the previous year. Meanwhile, shipments of twin-screw extruders declined 15 percent on a quarter-over-quarter basis and 11.2 percent from one year to the next. Injection molding machinery saw a decline of 6.1 percent on a quarter-to-quarter basis and dropped 23.6 percent on a year-over-year basis.

“The manufacturing sector is the main customer of the plastics industry,” PLASTICS’ Chief Economist Perc Pineda said. “Although the U.S. economy exhibited resilience in the first half of 2023, the decline in plastics machinery shipments signifies a subdued manufacturing landscape. Notably, the upswing in personal consumption expenditures (PCE) that followed the conclusion of the COVID-19 recession reached its peak in the first quarter of 2021, subsequently maintaining a consistent trajectory. Interestingly, PCE on services commenced its recovery at a slower pace post-COVID-19 recession, and this upward trend has persevered, playing a pivotal role in driving the economic expansion in the first half of the year.”

CES’ most recent quarterly survey of plastics machinery suppliers showed more participants anticipating an improvement in market conditions over the next 12 months compared to the previous year. The share of respondents expecting conditions to either remain the same or improve rose to 46 percent.

U.S. exports of plastics machinery rose 10.2 percent in the second quarter, reaching a total value of $252.8 million. Mexico and Canada held their positions as the prime export destinations for U.S. plastics machinery, collectively receiving exports worth $126.4 million – which is 50 percent of total U.S. plastics machinery export value.

Meanwhile, imports fell 10.5 percent, valued at $458.6 million. This shrank the trade deficit in plastics equipment by 32 percent, now standing at $205.8 million.

“As the economy readjusts, the shift between goods and services consumption is underway,” Pineda said. “However, sustaining a robust economic expansion, given a 5.5 percent benchmark interest rate or possibly higher in 2023, appears unlikely. The reliance on household debt for consumption raises concerns, particularly with the resurgence of student loan payments in September. This has the potential to adversely affect consumer spending and subsequently impact the plastics industry.”