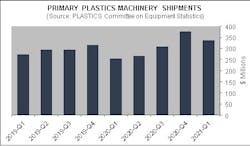

PLASTICS: Machinery shipments drop for first quarter of 2021

The Plastics Industry Association (PLASTICS) announced that while shipments of primary plastics machinery, which includes injection molding and extrusion, dropped 11.1 percent from the fourth quarter of 2020 to the first quarter of 2021, that is part of a typical trend over time, and compared to the first quarter of 2020, shipments were up 31.9 percent.

PLASTICS’ Committee on Equipment Statistics (CES) said the first-quarter results followed three consecutive quarters of growth. Injection molding equipment sales dropped 11.1 percent in the first quarter from Q4 2020, but it was 38.9 percent higher than the first quarter of 2020. Single-screw extruder shipments dropped 38.3 percent in value from Q4 2020, and were 28.9 percent lower than Q1 2020, but twin-screw extruder shipments were up 42.3 percent from Q4 2020, and 18.3 percent over Q1 2020.

Perc Pineda, chief economist of PLASTICS, said, “Judging from a year-over-year comparison, plastics machinery shipments were actually off to a good start. With the economy staying in a recovery cycle, plastics machinery shipments can be expected to increase this year. However, supply chain issues in plastics end-markets could slow growth in plastics equipment demand, so we’ll be watching market dynamics very closely in the coming months.”

CES found in a quarterly survey of plastics machinery suppliers that their outlook is very optimistic, and for the next 12 months, 93 percent of respondents expect market conditions to be steady-to-better – up from the 89.8 percent who expressed the same sentiment in the Q4 2020 survey. In addition, 89.5 percent of respondents expect conditions to improve or hold steady in the coming quarter compared to a year ago, a drop in sentiment from the 96 percent who held that view in the previous quarter.

“The equipment sector of the plastics industry came out of 2020 strong. The much-improved trade outlook will be a positive for plastics equipment suppliers on top of what can be expected as another good year for plastics equipment demand,” Pineda added.