Robot orders rise in 2025, but plastics and rubber sector still lags

Key Highlights

- North American robot orders increased by 6.6 percent in units and 10.1 percent in revenue in 2025, totaling 36,766 units valued at $2.25 billion.

- The plastics and rubber sector experienced a 9 percent decline in robot units and a 14 percent drop in revenue, but showed signs of recovery in Q4 with a 47 percent increase in units compared to Q3.

- Collaborative robots accounted for 28.6 percent of all orders in Q4 2025, with the plastics and rubber sector purchasing 20 units, representing about 11 percent of sector-specific robot orders.

- Policy uncertainty, supply chain disruptions and a pandemic-fueled backlog delayed investments in 2025, but easing conditions and government support are fostering a more optimistic outlook for 2026.

By Lynne Sherwin

North American robot orders rose in 2025, according to a report from the Association for Advancing Automation (A3). However, the plastics and rubber sector remained soft, although it showed improvement in the fourth quarter.

Companies across North America ordered 36,766 robots valued at $2.25 billion in 2025, a 6.6 percent increase in units delivered and a 10.1 percent increase in revenue year over year.

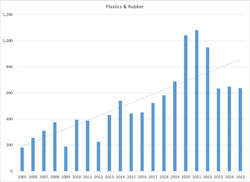

Plastics and rubber customers ordered 638 robots in 2025, totaling $29.3 million, a decline of 9 percent in units and 14 percent in revenue on an adjusted basis, said A3 EVP Alex Shikany.

The fourth quarter of 2025 showed orders of 10,325 robots valued at $579 million for all customers in the region, an increase of 6.6 percent in units and 8.7 percent in revenue compared to Q4 2024, the sixth consecutive quarter of year-over-year growth.

Plastics and rubber customers ordered 190 industrial robots in Q4 2025, representing $7.9 million in revenue. That was down 7.9 percent in units and 23.5 percent in revenue year over year, but Shikany said it “marked a meaningful improvement” from Q3, with orders increasing 47 percent in units and 28 percent in revenue.

“In short, 2025 remained a challenging year overall for the sector, but the fourth-quarter rebound suggests conditions improved somewhat heading into 2026,” Shikany said.

Collaborative robots accounted for 28.6 percent of robots ordered by all customers in Q4 2025 and 14.7 percent of quarterly revenue — 2,953 units valued at $85 million, the highest quarterly volume of 2025. Plastics and rubber customers purchased 20 collaborative robots valued at $686,000, about 11 percent of total robot units purchased in the fourth quarter by companies in the sector.

“Collaborative robots remain a relatively small but growing part of the mix” in plastics and rubber, Shikany said.

In November, after the results of Plastics Machinery & Manufacturing's (PMM's) annual survey showed 57 percent of respondents planned to buy robots or other automation in 2026, Shikany commented that despite slower sales in the sector in 2025, the overall direction was positive and “the intent to invest is strong.” He cited timing, policy uncertainty and supply chain issues as factors holding the market back.

Revisiting those comments after A3’s year-end report was released in early February, he said “some of that uncertainty does appear to be easing.”

“We heard a lot of that hesitation throughout 2025, and uncertainty was a dominant theme across the year. Trade policy, tariffs and broader geopolitical maneuvering made it difficult for many customers to clearly understand what the operating environment was going to look like, and that naturally led to delays in capital investment decisions,” he said, and that affected many sectors, not just plastics and rubber.

Indicators such as the economic policy uncertainty index have come down, he said, and “from a capex perspective, that matters. When customers have more clarity, even incremental clarity, they are more willing to move forward.”

He said A3 members are cautiously optimistic as policy decisions are being resolved and there is renewed attention from the federal government to promote robotics and automation in support of reshoring and advanced manufacturing.

Timing continues to be a challenge, though, as processors are still working through the spike in robot orders generated by the COVID-19 pandemic.

“If you look at the data over a longer horizon, particularly around the COVID period, plastics and rubber manufacturers clearly pulled demand forward. Supply chain disruptions, extended lead times and uncertainty around equipment availability led many companies to place orders well in advance of when they actually needed the systems,” he said. “That resulted in a significant surge in orders during that period, followed by several years where the industry has largely been working through that backlog.”

Source: Association for Advancing Automation

Makers of plastics processing equipment have been struggling with the same issue for several years. Machinery OEMs and analysts contacted for comments on PMM’s buying survey are still reporting unfilled capacity, often for equipment that was purchased to meet pandemic needs.

Shikany called the current slowdown “less a lack of interest in automation and more of a digestion phase. Orders in plastics and rubber have effectively plateaued coming out of COVID, with relatively modest differences between 2023, 2024 and 2025. That reflects normalization after an unusually strong pull-ahead cycle rather than a fundamental pullback in demand.”

The long-term outlook for automation in the sector remains positive, as automation is one of the most effective tools to stay competitive in the face of labor shortages, global competition and potential reshoring in North America, he said.

“So, while the rebound isn’t happening all at once or on a uniform timeline, the long-term trajectory hasn’t changed. The intent to invest is still there; it’s simply playing out more gradually as the industry moves past the post-COVID reset and into its next growth phase.”

For the entire North American market, robot demand from non-automotive customers outpaced demand from the automotive industry in 2025, with the majority of units going to general industries. Food and consumer goods, semiconductors and electronics, and life sciences all contributed to that momentum, according to A3’s report.

“We’re seeing increasing adoption across sectors, especially in general industry applications and at automotive OEMs, as manufacturers look to automation to address workforce shortages, manage reshoring initiatives and boost productivity,” Shikany said in a press release from A3.

He also pointed to the significance of Q4 trends. “Automotive OEMs came back strong in the second half of the year, which often serves as a leading indicator for growth in supplier and component markets. Combined with steady demand across food, electronics and other non-automotive industries, this points to a positive outlook for 2026.”

The automotive rebound is “an important piece of the equation” for the plastics and rubber sector, Shikany told PMM.

“OEM robot orders increased last year, while component and Tier supplier investment lagged, largely due to uncertainty around vehicle platforms and electrification strategies. As OEMs gain more clarity on their lineups and long-term plans, we would expect component suppliers to follow, consistent with historical ordering patterns where their investments tend to trail OEM activity,” he said.

“Taken together, plastics and rubber fits squarely into this broader picture. The hesitation we saw in 2025 was real, but as uncertainty continues to unwind, we expect investment activity to gradually pick up as we move through 2026.”

About the Author

Lynne Sherwin

Managing Editor

Managing editor Lynne Sherwin handles day-to-day operations and coordinates production of Plastics Machinery & Manufacturing’s print magazine, website and social media presence, as well as Plastics Recycling and The Journal of Blow Molding. She also writes features, including the annual machinery buying survey. She has more than 30 years of experience in daily and magazine journalism.