A3 report shows growth in robot orders over 2024, but a decline for plastics and rubber

North American robot orders rose in the third quarter year-over-year, according to a report from the Association for Advancing Automation (A3). A total of 8,806 robots valued at $574 million were ordered in Q3, an 11.6 percent increase in units and a 17.2 increase in revenue year-over-year (Y/Y).

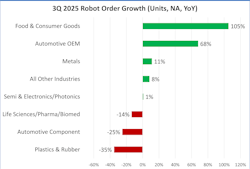

Growth sectors included food and consumer goods, which jumped 105 percent Y/Y, and automotive OEMs, which rose 68 percent. However, orders for the plastics and rubber sector fell 35 percent Y/Y, and automotive component orders dropped 25 percent, reflecting “sector-specific capital slowdowns,” according to A3.

A3 began reporting collaborative robot (cobot) volumes in 2025, and in Q3, companies ordered 1,174 cobots valued at $42 million, accounting for 13.3 percent of total units and 7.2 percent of total revenue.

From January through September 2025, companies in North America ordered 26,441 robots valued at $1.7 billion, a 6.6 percent increase in units and a 10.6 percent increase in revenue compared to the same period in 2024.

In the same period, companies ordered 4,259 cobots at a value of $156 million, representing 16.1 percent of total units and 9.4 percent of total revenue.

“It’s encouraging to see robotics demand improve over last year, with more automation projects steadily returning to the pipeline,” said Alex Shikany, executive VP at A3. “The market has experienced a substantial amount of economic and policy uncertainty this year, and it’s been a challenging environment for capital investment, but there is upside. We’re seeing sustained interest from companies across the region, with attendance rising at events like Automate, and more leaders are exploring automation as a long-term strategy to strengthen their operations.

“That enthusiasm is now starting to show up in the order data, particularly across general industry sectors,” he said. “As industrial production improves into 2026 and supply chains stabilize, we expect automation to remain a strategic priority for manufacturers looking to compete, build resilience and address persistent workforce pressures.”