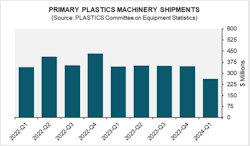

PLASTICS report shows sharp decrease in machinery shipments in Q1

Shipments of injection molding and extrusion machinery dropped nearly 25 percent in the first quarter of 2024, according to the Committee on Equipment Statistics of the Plastics Industry Association (PLASTICS).

The shipment value was $261.9 million, down 24.8 percent from the previous quarter and 24.2 percent year over year, according to initial estimates.

Single-screw extrusion machinery suffered the steepest decrease, 47.7 percent quarter

over quarter and 23.4 percent year over year. Twin-screw extrusion showed a 7.0 percent decrease from Q4 and a more substantial 17.0 percent decrease year over year.

Injection molding machinery shipments fell by 33.8 percent from Q4 and 24.9 percent year over year.

“It is common to see lower shipments in the first quarter of each year. Long-term data confirms this consistent pattern. Accounting for such seasonality, shipments decreased by 8.5 percent quarter over quarter,” said Perc Pineda, chief economist at PLASTICS. “This time, plastics machinery suppliers reacted in alignment with the overall pullback in the macroeconomy and a still-high interest rate environment.”

Results from the committee’s quarterly survey showed 74.4 percent of participants anticipating steady or improved market conditions over the next 12 months. Almost half (48.9 percent) indicated an increase in quoting activity compared to 17.1 percent of participants in the previous survey.

In Q1 2024, U.S. total exports of plastics equipment fell by 7.4 percent, while imports rose 7 percent from the previous quarter. Mexico and Canada jointly accounted for $191.4 million in exports, 47.9 percent of total U.S. plastics machinery exports globally.

Pineda said, “While still strong, the U.S. economy is poised for another year of growth, albeit at a slightly lower rate. However, growth in housing is hampered by higher borrowing costs, which also applies to higher capital expenditure financing in the business sector, including equipment investment in plastics manufacturing.” He added, “Manufacturing holds significant potential for growth, currently hindered by prolonged inventory adjustments and the rebalancing of consumption between goods and services.”