PLASTICS reports Q3 growth in plastics machinery shipments

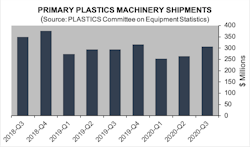

Shipments of primary plastics injection molding and extrusion machinery saw double-digit growth in the third quarter, according to statistics compiled by the Plastics Industry Association’s (PLASTICS’) Committee on Equipment Statistics (CES).

The report estimated the value of shipments at $306.7 million, which was a 15.8 percent increase over the second quarter, and a 4.6 percent increase compared to the third quarter of 2019.

Single- and twin-screw extruders saw increases in the third quarter of 27.4 percent and 17.5 percent, respectively. Injection molding machine shipments were up 15 percent from the second quarter, and 7.9 percent higher than the third quarter of 2019.

The value of plastics machinery exports hit $298.8 million in Q3, a 3.4 percent increase from the previous quarter. Imports rose to $754.6 million, a 16.2 percent increase. This pushed the trade deficit to $455.8 million, a 26.4 percent increase from the previous quarter.

Canada and Mexico remain the top export markets, and combined exports to the USMCA trade partners totaled $124.5 million, accounting for 41.7 percent of U.S. plastics machinery exports in the third quarter.

“Shipments of plastics machinery have increased for two consecutive quarters. The double-digit increases in the third quarter are in sync with the quicker-than-expected turnaround in other plastics end-markets in addition to healthcare and consumer essentials,” said Perc Pineda, chief economist of PLASTICS. “Most likely, shipments of machinery will also increase in the final quarter of 2020 as the economy continues to recover.”

In the quarterly survey that CES also conducts, 76 percent of responding manufacturers of plastics machinery said they expect conditions to hold steady or improve in the coming quarter compared to the same quarter of last year. This tops the 36 percent of respondents who held the same opinion in Q2. For the coming year, 89.8 percent of respondents expect steady or improved market conditions — handily topping the 48 percent of respondents who held the same opinion in the second quarter.

“It appears that the second quarter was the trough of the business cycle, as the economy slowed due to the pandemic,” Pineda said. “Recent data point to an industry that’s moving towards the pre-COVID-19 level of activity. The industrial production index on plastics products manufacturing rose for five consecutive months through September.”