Reading the plastics industry tea leaves

By Ron Shinn

It is a truism that you can make statistics say anything you want. It is also true that various plastics industry statistics published recently say, well, whatever you want.

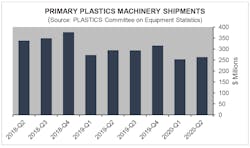

Start with the second-quarter primary machinery shipments compiled by the Plastics Industry Association’s (PLASTICS’) Committee on Equipment Statistics that show a slight improvement over a poor first quarter. The value of injection molding and extrusion machinery shipments increased 4 percent from the first quarter but was still far below the second quarter of 2019.

The gain pretty much reflects the gradual improvement in the U.S. economy, according to analysis provided by PLASTICS. An interesting point is that the second quarter had been predicted to be the worst quarter for the machinery industry.

But only 24 percent of the respondents expect U.S. market conditions to be steady or better during the next 12 months.

European machinery manufacturers saw a 6 percent decline in sales in 2019 after 11 years of growth and expect a 30 percent sales decline in 2020, according to the VDMA, the German machinery manufacturers trade association.

Ulrich Reifenhäuser, chairman of the VDMA’s plastics and rubber machinery division, said COVID-19 was a “stab in the back for industries that had already been performing badly.” Some 80 percent of European plastics machinery manufacturers say it will be 2022 before sales return to 2019 levels.

This is particularly interesting since one out of every four plastics machines produced in the world comes from Germany, according to the VDMA.

Italian machinery manufacturers also say that recovery to pre-pandemic levels probably won’t happen until 2022, at the earliest. Amaplast, Italy’s plastics and rubber machinery trade association, said production and exports sank 6 percent in 2019 after eight straight years of growth. There was an additional 27 percent decline during the first three months of this year.

The Canadian Mold Makers Association reported that furloughed employees have dropped from an average of 400 per month to fewer than 20, but members predicted that a second wave of COVID-19 is coming. The closed U.S. border was cited as a major problem for the industry and members said they are looking for new customers in Mexico and South America.

Overall, 80 percent of Canadian mold makers said the industry’s troubles will last longer than nine more months.

Chinese injection molding machinery maker Haitian reported sales were flat during the first six months of 2020, but gross profit increased 6 percent over the same period a year ago. Haitian said a roll-out of its third-generation machines contributed to improved revenue.

Haitian believes its domestic market will improve in the second half of 2020, but that may not continue into 2021.

“In the second half of the year, as the U.S. presidential election is approaching, campaigns of key issues surrounding China will bring more disadvantages to the domestic economy,” the company said in a news release. “Meanwhile, trade disputes, deglobalization and geopolitical crises among countries will continue to bring many uncertain risks to the global economy. The world’s major investment banks have substantially lowered their economic expectations of the world and major economies.”

While Haitian was holding steady, Milacron reported second-quarter sales of plastics processing machinery and hot runners fell 23 percent, compared with the same quarter a year ago. The company blamed the slowdown on the pandemic-related shutdown in India and a weakness in the automotive market.

While it is not specific to the plastics industry, the Institute for Supply Management’s three purchasing manager’s indexes — production, new orders and prices — all rose for the third consecutive month. The export and import indexes also increased, suggesting a growing demand for manufactured products.

So, what does it all mean? Manufacturing will likely continue to be ruled by uncertainty for months to come. You can find reasons to be optimistic or pessimistic here, and you will probably be right.

Ron Shinn, editor