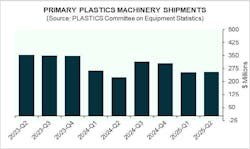

Shipments of injection molding and extrusion equipment in the second quarter of 2025 in North America were estimated at $253.8 million — up 0.7 percent from both the previous quarter and the same period last year, according to the latest report from the Plastics Industry Association’s (PLASTICS’) Committee on Equipment Statistics (CES).

Twin-screw extruder shipments jumped 48.5 percent from the first quarter, and more than doubled (115.4 percent) year over year. Single-screw extruder shipments were down 11.1 percent from Q1, but up 6.5 percent year over year. Injection molding shipments dropped 3.1 percent from Q1, but rose 5.4 percent year over year.

“Shipments stopped falling in the second quarter. In fact, comparing the first half of 2025 to the same period in 2024, shipments increased by 3.5 percent. It seems the plastics industry had a better handle on ongoing trade and tariff challenges across the value chain in the second quarter compared to the first,” PLASTICS Chief Economist Perc Pineda said.

Still, high tariff rates remain a concern.

“If the overarching goal is to strengthen U.S. manufacturing competitiveness — a goal the plastics industry fully supports — then, in the short term, the industry should be able to import production inputs and equipment no longer made in the U.S. at lower tariff rates,” Pineda said.

A survey conducted in early August by Endeavor Business Intelligence, the research division of Plastics Machinery & Manufacturing’s parent company, EndeavorB2B, indicated that nearly 70 percent of the business leaders who responded said the trade measures imposed by the Trump administration, as well as some retaliatory actions by trading partners, are “significantly” affecting their operations. The survey was taken before reciprocal tariffs kicked in Aug. 7.

Plastics processors, in a separate survey conducted by PMM, said the trade situation was disrupting their businesses, and PLASTICS previously stated its opposition to wide-ranging tariffs and their potential to hamper the industry.

The second-quarter survey of CES members also reflected uncertainty, as 58 percent of respondents expected market conditions to remain steady or improve over the next 12 months — down from 62 percent in Q1. However, 76 percent noted an increase in quoting activity, up from 65 percent in Q1.

Plastics machinery imports into the U.S. fell 7.9 percent in the second quarter but rose 1.9 percent compared to the same period last year. Total exports increased 0.4 percent from Q1, but declined 4.3 percent year over year.

“The advance estimate of U.S. real GDP showed a 3.0 percent increase in the second quarter, rebounding from the 0.5 percent decline in the previous quarter. This growth was largely driven by a sharp drop in imports, which are subtracted in the calculation of domestic output,” Pineda said. “However, the broad-based increase in household spending — across durable goods, nondurable goods and services — also points to room for growth in plastics manufacturing, particularly as imports decline.”

About the Author

Lynne Sherwin

Managing Editor

Managing editor Lynne Sherwin handles day-to-day operations and coordinates production of Plastics Machinery & Manufacturing’s print magazine, website and social media presence, as well as Plastics Recycling and The Journal of Blow Molding. She also writes features, including the annual machinery buying survey. She has more than 30 years of experience in daily and magazine journalism.