By Lynne Sherwin

It’s difficult to get Americans to agree on much these days, but respondents to a recent Plastics Machinery & Manufacturing poll spoke mostly in unison on one issue: The chaos in U.S. trade policy is bad for business.

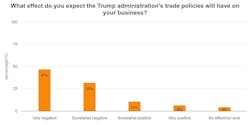

Asked about the effect of the Trump administration’s trade policies on their business, 47 percent of respondents said it was “very negative,” and 32 percent said “somewhat negative.” Eleven percent said “somewhat positive,” and 6 percent said “very positive.” Four percent said they didn’t know or weren’t sure yet.

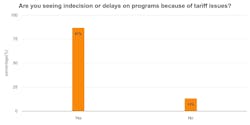

Eighty-seven percent of respondents said they were seeing customer indecision or delays — one said customers are “spooked as hell” — because of tariff issues. Cost increases, especially for raw materials, equipment and tooling, as well as a slowdown in the overall business climate, are driving uncertainty.

Managing through chaos: Learn how to lead your business through uncertain times. Read more.

Two commenters noted the lack of American producers of tooling steel, and another said molds being built overseas had been delayed.

Another summed up the situation in a single word: “Bad.”

But a few expressed optimism, with one saying, “We are quoting so many opportunities to provide American-made content which will lead to many more good-paying jobs,” and another advising, “Things are going to be fine, relax.”

More comments from poll respondents about the current state of their businesses:

- “All our customers are waiting to make large purchases because of the uncertainty around tariffs. With the addition of de minimis, even having samples and other items mailed that are under $800 will be difficult.”

- “The on-again, off-again tariff policy is creating volatility and no one can come up with a strategy because everything keeps changing. Trade wars are never good, but we have seen some interest in reshoring. However, this was already happening from what we learned during Covid and supply disruption.”

- “This is a wasted effort. The only thing that should be tariffed is mold making. ... This should have been done 40 years ago. It is too late to change what we have lost in skill.”

- “We are stuck in an expensive game being played for folks that have no stake in it!”

- “How the hell can anyone plan given the arbitrary and capricious nature of this policy?”

Tariffs’ effect on machinery purchases, reshoring

The trade situation doesn't bode well for machinery OEMs’ sales, either.

PMM’s annual survey of processors, conducted in October and November 2024, indicated optimism, with 66 percent of respondents planning to buy primary equipment after high interest rates and recession fears were expected to subside. Many OEMS said at that time they expected a gradual rebound in sales in 2025 due to improved economic conditions, especially lower interest rates.

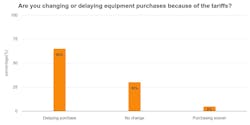

But in the new PMM poll, conducted in late April and early May, nearly two-thirds of respondents said they were delaying equipment purchases because of the tariffs, “waiting for the dust to settle,” as one said.

Five percent of respondents said they had bought equipment sooner than expected, with one commenting: “Before implementation of the tariffs, we acquired new equipment earlier to avoid tariffs.”

Thirty percent said they had not changed purchasing plans — “moving ahead as needed to remain competitive in the market,” as one respondent said.

“We'd planned to expand our processing operation this spring, but everything is on hold due to recession concerns,” said one, while another wrote, “We need to order equipment from Germany that has a six-month or more lead time. It is impossible for us to know what the cost of that equipment will be. If it is the proposed 20 percent, it will make it very difficult to justify the project.”

The most recent survey by the Committee on Equipment Statistics of the Plastics Industry Association (PLASTICS) showed a 12 percent drop in injection molding and extrusion machinery shipments from Q3 to Q4 of 2024, fueled by economic policy worries.

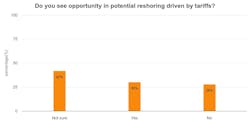

The only question on PMM’s poll that split opinions somewhat evenly was whether tariffs would drive opportunity through reshoring: 30 percent said yes, 28 percent said no and 42 percent were not sure.

In comments, several said they expected business to return to the U.S., but that it would take time, and the economic winds could change direction again.

“Hopefully this [reshoring] occurs, but is likely several YEARS out,” one wrote.

“I’m not investing big dollars on a machine that may never get turned on after the next election,” another said.

Others are more optimistic: “I think our short-term pain is going to have long-term rewards for the United States and business growth.” Another respondent said his or her company was in the process of moving a program from Canada to a new manufacturing cell in the U.S.

One person echoed the recently released Kearney Reshoring Index report, and comments by Harry Moser of the Reshoring Initiative, both noting that the lack of skilled workers is a bigger hurdle to reshoring than trade policy:

“Certainly there are opportunities for reshoring; however, the net effect remains uncertain due to the lack of qualified, trained/educated workers. The U.S. should make a priority in investing in trade education programs. Tariffs are not the near- or long-term solution. Education is.”

Question 1

More comments on Question 1

"Unsure of effects, some prices are affected but we are also seeing an uptick in quoting, a lot of which is onshoring production."

"It's going to cause a downturn at first but once through it will be a positive change, something this country has needed to do for years."

"While we have sources in other countries, China is a big supplier for our business. Tariffs will affect our pricing and lead time for all of our customers. In some cases there are not alternative suppliers to those in China — not in the US or anywhere else in the world that we can find. So, some of our customers may disappear, or be forced to increase their pricing, or use other products that may not work as well. In addition we have already seen price increases from most of our suppliers, including those not being made in China, just because they can (or need to absorb that cost from all of their sales). Since most of our customers are other manufacturers, I would expect to see these tariff policies ripple into price effects or shortages for everyone. I am also very worried that policies around Chinese-made or managed shipping vessels will cause massive port congestion and container shortages that will affect every business from every country."

"Most tools are built in Asia; there is not enough capacity or skilled toolmakers in the USA to make up the difference."

"Customers are pausing purchases of plastics processing equipment due to the chaos that has ensued after the Orange President has spooked markets. We have European customers turning to Chinese suppliers."

Question 2

More comments on Question 2

"We'd planned to expand our processing operation this spring, but everything is on hold due to recession concerns."

"Trade liberalization, my ass! TRADE ISOLATION!!"

"It will be great in the long run."

"Delays in hiring, new equipment delays."

"We all know it’s just a political stunt. Republicans and Democrats were in charge when this was needed during the 40 years' period so no one should be blaming the other party."

"We have been experiencing many customers ordering less frequently because their pricing has gone up in other areas. They cannot afford to buy anything other than whatever is an emergency. This culture is continuing as uncertainty around tariffs continues."

"No one knows what the hell is going on or what they should do regardless of where they are sourcing."

Question 3

More comments on Question 3

"When it comes to tariffs free trade is ignored and the countries all have resources they export that will be raised so what’s the point?"

"Waiting to see if the tariff issue subsides."

Question 4

More comments on Question 4

"I think our short-term pain is going to have long-term rewards for the United States and business growth. So I hope for reshoring or nearshoring to Mexico will be a great opportunity for our country as soon as we have a trade deal in place."

"Global trading is common business practice."

"It will take time to see how this will affect us. There are too many variables to consider that could affect the outcome that we do not know about."

"We already were planning an expansion. The unsettled tariff situation now makes it more difficult to plan with any certainty."

"Cost of doing business in USA could be cheaper in the long run."

About the Author

Lynne Sherwin

Managing Editor

Managing editor Lynne Sherwin handles day-to-day operations and coordinates production of Plastics Machinery & Manufacturing’s print magazine, website and social media presence, as well as Plastics Recycling and The Journal of Blow Molding. She also writes features, including the annual machinery buying survey. She has more than 30 years of experience in daily and magazine journalism.