Plastics machinery shipments see three consecutive quarters of growth

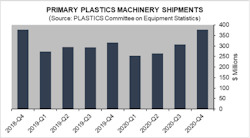

Fourth-quarter shipments of injection molding and extrusion primary machines saw double-digit increases, the third consecutive quarter of growth for the sector, according to statistics from the Plastics Industry Association’ (PLASTICS’) Committee on Equipment Statistics (CES).

Information from reporting companies put the total estimated value of shipments at $376.8 million, a 22.9 percent increase over the third quarter, and a 19.3 percent increase compared to Q4 of 2019.

The value of single-screw extruders rose 31.6 percent in the last quarter of 2020, and twin-screw models rose 4.5 percent. Injection molding equipment shipments rose a solid 23.1 percent from the third quarter of 2020 and were up 21.2 percent compared with the fourth quarter of 2019.

“The three consecutive quarters of double-digit increases in plastics machinery shipments underscore the importance of plastics machinery, not only in the plastics industry, but in the manufacturing supply chain of the economy, considering that most plastics are used in manufacturing,” said Perc Pineda, chief economist at PLASTICS. “We were hoping to see an increase in shipments of machinery in the fourth quarter as the economy stayed in the recovery cycle and that’s exactly what we got.”

In a quarterly survey about present market conditions and future expectations conducted by CES, 96 percent of the plastics machinery suppliers that responded said they expect conditions to hold steady or improve compared to a year ago. That shows more optimism than in the third quarter, when only 76 percent of respondents held that view. Looking ahead to the next 12 months, 86 percent foresee market conditions to be steady-to-better, which is a slight drop from the 89.8 percent who answered that way in the third-quarter survey.

- Read about optimism expressed by OEMs and processors in a recent PMM survey.

- Read PMM Editor Ron Shinn’s commentary on processors’ need for new machinery despite the cancellation of NPE2021.

“The value of shipments of plastics and rubber products in December was 1.1 percent lower than a year ago — much less than the 11 percent decrease in April year-over-year due to the pandemic,” Pineda said. “Against the backdrop of a recovering domestic and global economy, the growth momentum in plastics end markets that began in the second half of 2020 is expected to continue through 2021, which should sustain a steady demand for plastics materials and resin, products, machinery and molds for plastics.”

Total fourth-quarter exports of plastics machinery reached $360.9 million, up 20.8 percent from the previous quarter. Imports for the same period reached $875.5 million, an increase of 16 percent, leading to a trade deficit of $514.6 million — up 12.9 percent from the previous quarter.

Exports to Canada and Mexico — the top export markets for U.S. equipment suppliers — reached $173.4 million and accounted for 48 percent of total U.S. plastics machinery exports in the fourth quarter.