Listen to the podcast

The domestic auto industry is in big trouble, with no sign that things will get better anytime soon. We all know that when the auto industry gets the sniffles, the plastics industry catches a cold.

After considerable stops and starts, automakers seemed to be figuring out how to transition their business models to electric vehicles (EVs). There were significant technology hurdles to overcome, but many of the big ones, such as limited battery life, few charging stations, higher cost than internal combustion vehicles and general consumer acceptance, were on their way to being solved.

Solvay SA is building a plant in Georgia to produce polyvinylidene fluoride (PVDF) resin used in EV batteries. SABIC and LG Chem have also been active in developing flame-retardant battery packs and enclosures.

Entek is investing $1.5 billion in a battery separator film plant in Indiana.

Even plastics processors supplying the auto industry adapted to shorter parts programs after years of enjoying model cycles that ran five to seven years.

Processors also developed techniques to mold sensors and electrical components into panels and parts.

Domestic buyers have not rushed to spend their money on EVs, but EVs make up a growing share of the market.

Total domestic auto assemblies dropped precipitously when the COVID pandemic hit in early 2020 and rebounded halfway back in mid-2021, but declined again and did not improve until mid-2022. Since then, assembly totals have been up and down, but still far below the 2015 high of 12.3 million vehicles. Assemblies are a good way to measure U.S. vehicle output since sales figures include imported vehicles.

High interest rates and supply chain disruptions have played a big part in sales and assembly totals. Both came at a time the auto industry needed a robust market to help pay for the continued transition to EVs.

Now there is additional uncertainty caused by on-again-off-again tariffs on goods imported from Canada and Mexico as well as steel and aluminum from everywhere.

Unfortunately, when the auto industry — and its plastics industry suppliers — need encouragement and support from the federal government, they are not getting it. Instead, the federal government’s actions are working against the auto industry.

Tariffs that penalize domestic carmakers from importing vehicles or components they build in Canada and Mexico are not helpful. Tariffs will make vehicles more expensive, depress sales and keep automakers in a survival mode instead of a growth mode.

What is the most probable growth path for automakers? Consumers are warming to EVs. Overall vehicle demand has held steady despite rising prices and high interest rates. EV cars and trucks are very important to automakers’ future.

Set aside the argument that EVs are better for the environment. I’ll save that discussion for another day.

But while domestic EV production may be slowed by tariffs and automakers trying to figure out how to move forward, other countries are racing ahead.

China, for example, last year proposed mandatory standards for electric consumption limits in new EVs. The standards are designed to encourage technology advancement and lightweighting, important for the plastics industry.

The biggest EV manufacturers are in China and their products are being sold around the world, although only a few Chinese-built models of other manufacturers are currently sold in the U.S. The Buick Envision SUV, Volvo S90 and Polestar 2 are built in China.

Last year, Chinese automaker BYD sold more than 4 million vehicles worldwide.

The New York Times recently reported that Xiaomi, a Chinese manufacturer of consumer electronics, sold 135,000 cars in 2024, just three years after starting development. It plans to double that number this year. Xiaomi has been known for selling low-cost, designer phones online. Now it is adding $30,000 EVs to its product list.

Could a company like Xiaomi succeed at selling EVs in the U.S.? I doubt it. It is absolutely true that Chinese automakers get significant help from their government, help that is not available to U.S. manufacturers.

Instead of just protecting the domestic automotive industry from outside competition, it would be more useful for the government to focus on finding ways to support it. I am not in favor of another industry bailout, but I am concerned that manufacturers in other countries will eventually make our domestic auto industry irrelevant.

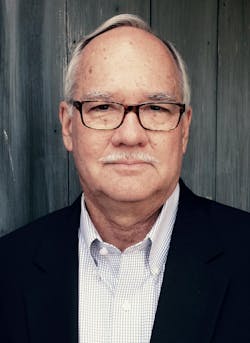

Ron Shinn, editor

About the Author

Ron Shinn

Editor

Editor Ron Shinn is a co-founder of Plastics Machinery & Manufacturing and has been covering the plastics industry for more than 35 years. He leads the editorial team, directs coverage and sets the editorial calendar. He also writes features, including the Talking Points column and On the Factory Floor, and covers recycling and sustainability for PMM and Plastics Recycling.