Polymer trends: Adapting to changing market realities

By Ashok Pant

Townsend Solutions

In 2023, the polymer industry had a rough year, dealing with a number of challenges and adjusting to a market shift toward a more sustainable future. Markets hoped for a recovery in the second half of 2024, thanks to a boost from further monetary easing, which would restore consumption to pre-pandemic levels. Buyers sought to stock up on cheap supplies in early 2024 in anticipation of a potential price rise amid geopolitical tensions in the Middle East. It appeared 2024 might be a better year.

That optimism, however, proved to be misplaced, and market activities and purchases fell soon after. Looking ahead, 2025 should be better, but it’s still early.

The blow molding industry is facing significant competition and market erosion. Flexible packaging is replacing rigid packaging, recycled material is gradually supplanting virgin, electric vehicles (EVs) are gradually gaining market share, and PET continues to make inroads.

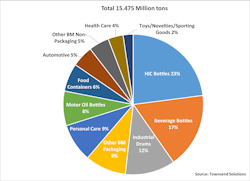

PE: Most of the demand for PE blow molding comes from packaging applications, including bottles for beverages and the household and industrial chemicals (HIC) sectors. Due to its strong chemical resistance and durability, HDPE is perfect for packaging chemicals and beverage products.

Additionally, HDPE bottles are commonly used for packaging milk in most of the developed world. These bottles have a longer shelf life, and are easy to use and transport. Other common blow molded HDPE products include industrial drums, bottles for motor oil and personal-care items. Figure 1 shows global demand for PE blow molding.

Global PE demand by application, blow molding, 2024

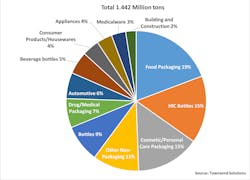

PP: PP occupies a much smaller blow molding segment, compared with the dominance of HDPE. For single-use beverage packaging, PET is the material of choice. However, PP still receives significant demand from the food packaging industry because of its proven safety for food products even at high temperatures. It doesn’t leach harmful chemicals and is known for its durability and strength. It is also used in HIC bottles, mostly for higher-value products, justifying higher packaging costs.

Another major segment for PP blow molded bottles and containers is the personal-care sector, which is likely to see healthy growth in developing regions and flat growth in developed regions. Figure 2 shows global demand for PP blow molded markets.

Global PP demand by application, blow molding, 2024

PVC: For PVC, the market for blow molding is much smaller, as HDPE dominates the industrial packaging segment and PP dominates the food packaging segment. Although PVC is cheap, it requires additives and impact modifiers to be strong enough for use in blow molded packaging. Furthermore, the low productivity of blow molding machines makes PVC bottles very uncompetitive. Hotels occasionally use PVC bottles for shampoo and conditioner, but larger, refilled bottles are gradually replacing them.

Major challenges for the blow molding market

Inclusion of recycled content

With the growing plastic waste problem, the spotlight is on major brand owners, which have pledged to fight climate change and plastic waste. Brand owners such as Unilever and Nestle are driving demand for post-consumer recycled PP and PE for packaging applications. Many companies are adopting this trend to enhance their image by committing to plastic circularity and environmental protection. Among other pledges, most major brand owners have made common commitments to:

- Make packaging recyclable, reusable or compostable.

- Reduce the use of virgin polymers.

The second commitment will significantly impact demand for virgin polyolefins in the blow molding sector. However, this will occur gradually as the recycled polymer market faces challenges of its own. The biggest is the shortage of quality waste feedstock. Another issue is consumer willingness to pay a premium for post-consumer recycled (PCR)-based packaging. Some replacements might come from biobased plastics. The following table shows the sustainability pledges made by the world’s largest brand owners.

Table 1: Pledges by Large Brand Owners to Reduce Plastic Waste

|

Company |

Current Pledge |

Company |

Current Pledge |

|

Unilever |

Reduction in the consumption of virgin polymers by one-third by 2026 from 2018 levels |

Johnson & Johnson |

To ensure that 100 percent of plastic packaging be reusable, recyclable or compostable by 2025 |

|

Nestlé |

Make all packaging recyclable by 2025. |

Kraft Heinz |

To cut the use of virgin plastics in the global packaging portfolio by 20 percent by 2030, from 2021 levels |

|

Coca-Cola |

To make 100 percent of packaging recyclable globally by 2025. |

Mondelēz |

Design 100 percent of packaging to be recycle-ready by 2025. |

|

PepsiCo |

To design 100 percent of packaging to be recyclable, compostable, biodegradable or reusable. |

Mars |

Targets 30 percent average recycled content in plastic packaging by 2025 |

|

Colgate-Palmolive |

To eliminate one-third of new (virgin) plastics by 2025. |

Danone |

To reduce by 33 percent virgin plastic compared to 2019 levels |

In addition to corporate commitments, government regulations also drive increases in recycled content in packaging. Since blow molded products are material-intensive, they are becoming a soft target for cost-cutting and regulations concerning the use of recycled polymers. The European Union’s Plastic Packaging and Waste Regulation (PPWR), adopted in December 2024, for example, will change the plastic packaging industry in the EU. In the long term, it will lead to market erosion of virgin resins by recycled resins in blow molding.

With the implementation of PPWR, packaging must be reusable or recyclable by 2030. It will force packaging producers to include recycled content in growing quantities with predetermined targets for 2030 and 2040, as shown in Table 2.

Table 2: Recycled Content Target under the EU PPWR for Plastic Packaging

|

Packaging |

2030 |

2040 |

|

|

Single-use Plastic Beverage Bottles |

30 percent |

65 percent |

|

|

Contact-sensitive Packaging |

PET as major component |

30 percent |

50 percent |

|

Other than PET |

10 percent |

25 percent |

|

|

Other Plastic Packaging |

35 percent |

65 percent |

|

Outside continental Europe, regulations also take aim at increasing recycled material content.

- The U.K. has mandated that recycled materials make up at least 30 percent of the composition of products. If this condition is not met, the producer will bear a heavy plastic tax.

- California has mandated that plastic beverage containers include 15 percent recycled content.

- Australia has committed to including 30 percent recycled content in plastic packaging starting this year.

- Canada is contemplating a plan that would require at least 50 percent recycled material in plastic bottles by 2030.

- Several other countries, including New Zealand, South Africa, Mexico, Chile and Turkey, are seriously considering laws to reduce plastic waste and include recycled materials in packaging.

Markets for recycled blow molded products are evolving gradually. To seize the opportunities in this market and avoid erosion of an established customer base, petrochemical producers have started offering resins with PCR content, which have high brand value and performance assurance for potential customers. These companies also boast certifications such as ISCC (International Sustainability & Carbon Certification) for better marketing. Table 3 lists companies offering grades with PCR content:

|

Company |

Resin Grade |

Resin Type |

Recycled Material |

|

Total Energies |

50% rPE6314, 70% rPE 5673 |

r-HDPE |

50 percent PCR |

|

Total Energies |

rPP (Under Development) |

r-PP |

50 percent and 70 percent PCR |

|

SCG Chemicals Public Company Ltd. |

PCDH01BN, PCDH02BW, PCRH02BW, PCRH03BB |

r-HDPE |

PCR-HDPE |

|

Reliance Industries |

EcoRelene ECO HD03, EcoRelene ECO HD01 |

r-HDPE |

PCR-HDPE |

|

LyondellBasell |

CirculenRecover HD45U06 Natural |

r-HDPE |

40 percent PCR-HDPE |

|

LyondellBasell |

CirculenRecover HD5603 Grey |

r-HDPE |

98 percent recycled material based on PCW |

|

Braskem |

70% DA055A, 40% DA054B, 70% DA065A |

r-HDPE |

70 percent and 40 percent recycled material (PCR) |

|

Braskem |

100% DAR 004GC, 50% DAR 005A |

r-HDPE |

50 percent and 100 percent recycled material |

|

Braskem |

RPR 7A2 WE, 70% RPR 7A5 WE |

r-HDPE |

Post-consumer recycled polymer |

|

INEOS |

55% rHD5502WT, 50% rHD5402, 50% rHD5603 |

r-HDPE |

55 percent and 50 percent PCR |

Lightweighting to cut costs and sustain demand

Lightweighting continues to affect demand for polymers. Lightweighting can be achieved through various methods, including changes in packaging design or the die head. However, there are limits, after which the container’s performance begins to deteriorate, or its touch and feel can change. Consumers’ preferences might change with the touch, feel or look of packaging.

To support this trend, petrochemical companies have come up with more-advanced grades that facilitate the production of thinner containers that meet the same level of performance and offer material and cost savings. This has become a primary path to further lightweighting. Major petrochemical companies, such as LyondellBasell, ExxonMobil, SABIC, Japan Polyethylene Corp. and Dow Chemical, offer grades with high environmental stress crack resistance (ESCR), even at high stiffness. Dow Univation Technologies has a technology (Prodigy Bimodal HDPE Technology) for producing lightweighting grades that include blow molding applications.

Table 4 shows examples of companies offering grades specifically for lightweighting:

|

Company |

Resin Grade |

Resin Type |

|

Japan Polyethylene Corp. |

Metallocene HDPE Hifortec |

HDPE (Under Development) |

|

LyondellBasell |

Hostalen ACP 5231D, Alathon L5840 |

HDPE |

|

ExxonMobil |

HD 5705 (9856B), Paxon SP5004 |

HDPE |

|

Dow Chemical Co. |

Contiuum Bimodal HDPE series |

Bimodal HDPE |

|

SABIC |

BM6246LS |

Unimodal |

The next phase in the lightweighting trend is the introduction of foam-core multilayer blow molding. Bottles made from this process contain an innermost foamed layer that meets the dual objective of further lightweighting while maintaining the rigidity of packaging. This becomes far more important with the recycled content requirement as availability of quality feedstock is limited. This type of blow molding requires a foam extrusion head in more-advanced machinery along with suitable grades and foaming agent compliant with the process.

As products become lighter-weight, another major factor that guides demand for the thin-wall packaging market is increased stackability. Being able to stack packages minimizes the need for floor space during storage and transportation, contributing to storage cost reductions. Therefore, actual demand growth from consumer goods and the industrial sector does not reflect packaging volume growth because less material is being used.

PET is a major alternative to PE and PP in smaller bottle segment. Despite its higher density, it is possible to work with much thinner walls for the same volumes. In addition, the productivity of PET blow molding machines is much higher. With PET injection stretch blow molding, bottles have much better necks than bottles made from parison extrusion, allowing for the reduction in cap sizes. However, PE and PP dominate in larger and more functional bottle packaging due to ease of making handles.

Next stage of cost cutting is through flexible packaging

A general trend in both food and non-food packaging is the transition from rigid to flexible packaging to save costs. This is leading to the replacement of smaller bottles (less than 3 litres) with flexible multilayer packaging with refillable products. This is especially true in hygiene categories where stand-up pouches are considered a more sustainable and cheaper solution. Another threat to bottle manufacturers is from concentrate refill packs that need to be mixed with water at the consumer location. This has already sparked interest in applications in hygiene and personal care.

Like lightweighting, this is nothing new; firms have long used cheaper packaging options to manage costs. However, this has accelerated globally. Starting with liquid soap and floor cleaner to juices, producers are choosing flexible packaging wherever they can. Pouches provide more flexibility for printing than bottles, require less raw material and take less space during transportation.

Growing EV market to reduce HDPE demand in automotive applications

Electric vehicles (EVs), which do not require bulky fuel tanks and require fewer maintenance products than combustion-engine vehicles, are experiencing a surge in popularity. The EV industry is growing with substantial potential for expansion. According to the International Energy Agency’s Global EV Outlook 2024, EV sales have increased from 300,000 EVs in 2014 to nearly 16.6 million EVs in 2024, representing about 20 percent of the auto market. More than 91 percent of the EV sales were in China, Europe and the U.S.

Strong sales are also emerging in Southeast Asia, Brazil and India, albeit from much lower bases. If we look at the forecasts in various regions, it is evident that the share of EVs is on the rise at the expense of internal combustion engine (ICE) vehicles.

The EV phenomenon is also widespread in the two-wheeled segment, with more commuters buying electric two-wheelers to save costs and improve traveling experience. For some two-wheelers with a maximum speed of about 12mph to 19 mph, riders don’t need a driver’s license, making them popular in rural areas. E-commerce companies also use EVs for their door-to-door deliveries to save on fuel costs.

But, with the growing share of fully electric EVs, the need for fuel tanks and various other service products will decline, including lubricants. These products use blow molded HDPE containers; a decline in their market will affect the HDPE market.

Opportunities for the blow molding market

While it might appear that things are all going downward, there remain niche areas that can provide consistent growth for virgin materials in blow molding markets in the coming years.

Growth in energy and fitness segment

One benefit of urbanization is a focus on health, hygiene and fitness. Health and fitness drink sales are rising worldwide — a trend that’s expected to continue until 2030. Some customers, especially in cities, are seeking gyms, aerobics, yoga and other fitness courses to stay healthy. Thus, PE and PP bottle demand for health drinks is rising.

China's street drink sector is booming. These drink bottles feature exquisite product packaging, high-quality raw materials and decoration. Over the past few years, Internet take-away platforms and smartphones have changed lifestyles, boosting the catering take-out sector. As this trend accelerated, China's food and beverage take-out industry has grown significantly.

The use of beverage bottles is becoming more diverse, and the demand for bottles in the downstream food industry, street drinking, catering and other applications continues to increase.

Focus on industrialization and urbanization

Most countries are focused on diversifying their economies with a larger share of manufacturing. Rapid urbanization is occurring in tandem with the expansion of industrialization. Items formerly thought to be exclusively associated with cities are increasingly finding uses in more rural regions, as well.

This has driven the growth of hygiene, personal-care and cosmetic sectors as the urban lifestyle spreads through Tier 2 cities and rural areas. Innovations in cosmetic packaging will help support this demand. For instance, modern clarifiers make PP bottles clear, and 3D and modeling technologies make it possible to precisely make the tools needed for mass production of blow molded products. This makes it possible to create more specialized and functional packaging.

Some converters are even offering ultralightweight bottles that incorporate recycled content. Some claim weight reduction as high as 30 percent with recycled resins and up to 60 percent with virgin resins.

Growing replacement of rotomolded tanks

Rotomolding has been the preferred process for producing tanks for water, chemicals and waste storage. However, in the smaller-tank segment for both home and industrial usage, blow molding is gaining market share. Although there are some drawbacks with blow molding PE tanks, the method is preferred because it’s faster and cheaper, and appropriate for mass production.

Blow molded tanks have thinner corners, due to material stretching, but that’s not the case with rotomolded tanks, which have uniformly thick walls. Therefore, for tanks that have higher-storage and load-bearing requirements, rotomolding is preferred. Rotational molding is the only process for large or complex products. Because of their better build quality, such products are easier to weld or alter in post-processing.

India’s growth story to continue

India remains a rising market for polymer products despite a worldwide slowdown. The country has low per-capita polymer consumption and a huge appetite for PE, PP and PVC in the blow molding market. Among major economies, India has the fastest-growing GDP, which is expected to continue rising. While China has structural challenges and its development was driven by government-induced consumption and investment, India is a fundamentally robust market with an autonomous and stable real estate sector and a rising and younger population.

Economic challenges exist in India, however. The government is investing in asset creation and focusing on manufacturing. India’s expanding middle class continues to drive both consumption and investment.

According to the latest World Economic Outlook forecast (October 2024), the International Monetary Fund predicts India’s GDP to grow close to 6.5 percent in 2025–2029. Comparatively, China's GDP growth is expected to slow down from 4.8 percent in 2024 to 3.3 percent in 2029. Growth rates for the U.S. and the EU are projected to be 2.1 percent and 1.5 percent by 2029, respectively.

Even throughout the pandemic and the Russia-Ukraine war, India's polymer market grew strongly. Blow molding converters and processors should expect rising demand as the population grows and consumes more. India’s regulations are not very strict, which would inhibit polymer consumption. Overall, it will remain a growth market while the rest of the world faces either slowing demand or uncertain conditions.

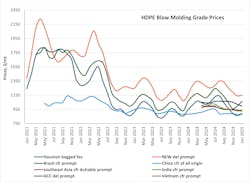

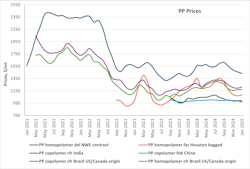

Pricing environment and demand in 2025

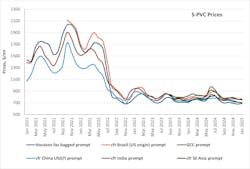

The polymer market has faced a unique situation in which producers and converters suffered from depressed prices and weak demand. Prices for HDPE, PP and PVC were elevated in 2021 and after the start of the Russia-Ukraine war in early 2022, but they began to decline in the second half of 2022 and remained depressed throughout 2023 and last year. There were a few brief spikes in the prices due to reasons such as logistics problems and shipment challenges in the Red Sea, etc. However, globally, except in India, virgin resin-producing companies have complained of contracting margins. The following HDPE, homopolymer and copolymer PP, and PVC suspension resin (S-PVC) charts show how prices have fallen.

After pandemic-era spending by the government and the cost-of-living crisis following Russia’s attack on Ukraine, central banks globally — other than the People’s Bank of China and Bank of Japan — adopted monetary tightening in 2023, which helped to reduce inflation by mid-2024. But this also meant that consumption was severely hampered, leading to weak demand for polymers such as PE, PP and PVC.

The central banks managed to achieve a “soft landing” by 2024, and this has allowed them to start monetary easing, injecting much-needed liquidity and momentum for economic growth. Now all eyes are on policy decision-making in 2025, and there are expectations of further rate cuts. It is expected that a decline in inflation and easy credit will provide some support to economic growth in 2025.

Although several other factors, such as supply-demand dynamics, policy initiatives, regional geopolitical tensions, trade wars and production competitiveness, determine demand growth in individual countries, from a macroeconomic point of view, 2025 should support a revival in prices and an improvement in margins for resin producers, as well as converters.

Concluding remarks

Amid regulatory restrictions and shifting market dynamics, the fate of the polymers blow molding sector is dependent on producers' ability to maintain competitiveness. Consumers prefer better-quality, better-looking and more functional packaging, while the need for cost cuts is imperative to provide more value. The business environment is ever-changing, but the need for flexibility has never been greater. Because not all converters and producers are in locations suited for growth, adaptability is essential.

Producers were anticipating some relief this year from easing monetary policies. However, the markets are once again plagued by uncertainty due to the fear of U.S. protectionist policies igniting a global trade war, especially as China's drive towards self-sufficiency is leading to overcapacity in the polymer markets.

The most important trend for European suppliers will be to adjust to PPWR regulations, while producers in other countries will have to improve their sustainable product offerings. The recycled polymer business does not currently pose a significant threat to the virgin polymer industry, but there has been a steady push toward more-sustainable solutions from governments and players in the entire value chain in most parts of the world.

There will be continued growth in Asia, but the market for virgin resin in Western Europe might decline. Slowing China means slowing global consumption, so it is quite possible that export-oriented resin producers in the Middle East and North America might target deficit markets such as India, especially with the renewal of the trade war between the U.S. and China.

© 2025, Society of Plastics Engineers Blow Molding Division

About the Author

Ashok Pant

Ashok Pant, consultant and project manager, Townsend Solutions, has more than 14 years of experience in the polymer and downstream petrochemicals sectors. His expertise lies in detailed market analysis covering major areas such as feasibility studies, market development opportunities, market entry strategies, and profitability analysis.

At Townsend Solutions, he manages consulting assignments and provides advisory services to the company’s diverse client base. As an author, he has been cited in industry magazines and websites, such as Polymer & Tyre Asia, Chemical World, Plastics Today and Society of Plastics Engineers. He is based in Mumbai, India, and can be reached at [email protected].

This article appeared in The Journal of Blow Molding.